A THRIFTY mum who lives next to Wimbledon has told how she rakes in £1,300 in just two weeks with a clever side hustle.

This year’s tennis tournament kicks off today and as many as 500,000 people are expected to attend the tournament over the two weeks.

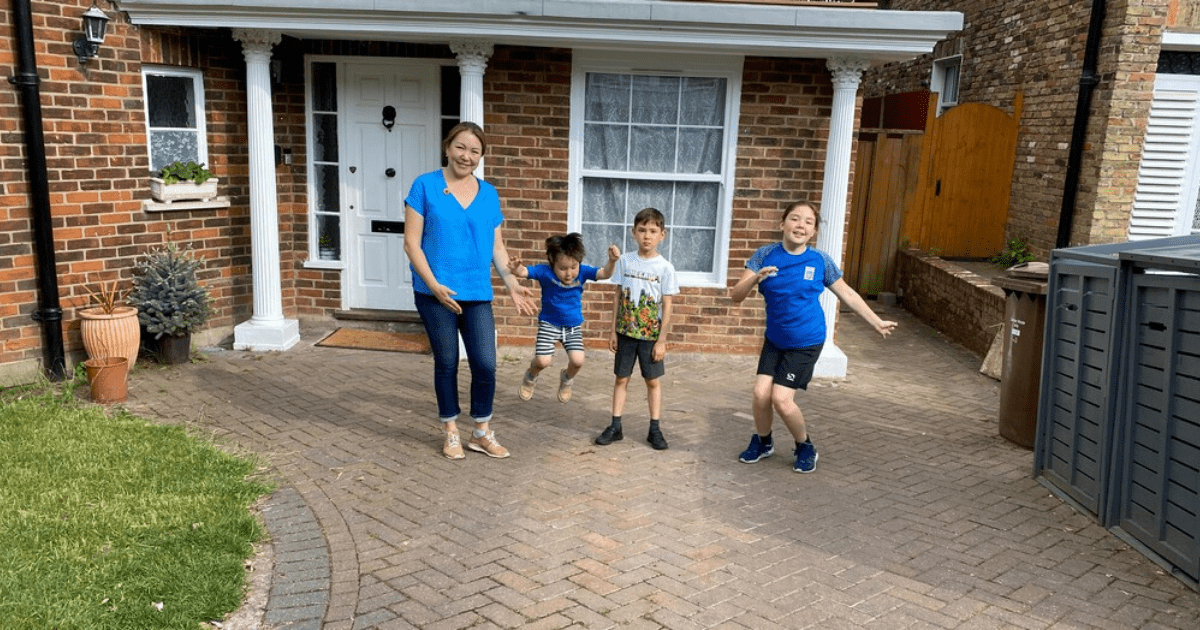

Aliya Aralbayeva, of Wimbledon, makes cash renting out her driveway during the tennis tournament

With so many fans flocking to the area, Aliya Aralbayeva, from Wimbledon, decided to cash in by letting out her driveway.

Last year she took home a comfortable £1,300, by renting out her space via YourParkingSpace.

She said: “Every year there are always the same parking issues during the tournament and that’s when I realised that I could offer my spare spot to visitors.

“I live so close to the venue and they’re so happy when they realise it’s just a short walk.

“I actually donate my earnings during this period to a Ukrainian healthcare sector charity due to the amount I am able to bring in.”

Official Wimbledon Championships parking sets tennis fans back £40 a day but spaces are “strictly limited”.

There is also the option of “park and ride” for £15 a day, but it’s as bus journey away from the action.

Parking prices elsewhere in the area, where the average house goes for £622,579 versus the £278,000 UK average, vary – and there is also high competition for bays.

While it’s entirely legitimate to rent out space on your property, there are a couple of things to consider first.

Be sure to check with your home insurance provider, in case doing so invalidates your policy. You may need to buy additional cover to protect yourself in case someone causes damage when they park.

Don’t forget about the taxman either. You can make £1,000 a year before paying any tax by renting out space on your land such as your driveway, a shed or garage.

This is due to something called the Property Allowance, which resets with the stat of each new tax year on April 6.

But any profits you make above this amount need to be declared to HMRC through a self-assessment tax return.